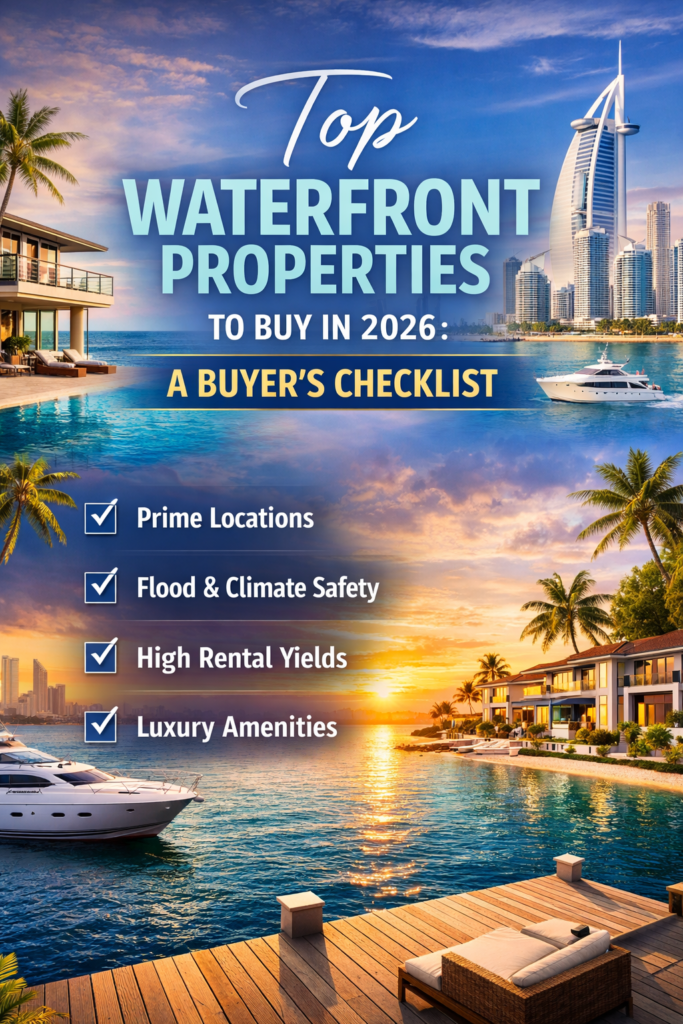

Waterfront properties continue to dominate the luxury and investment real estate market in 2026. From scenic sea views to high rental yields, buying a waterfront home is no longer just about lifestyle—it’s a strategic financial decision. With rising demand across global coastal cities, knowing what to look for before buying waterfront properties is crucial.

This buyer’s checklist will help you make a smart, future-ready investment.

Why Waterfront Properties Are in High Demand in 2026

Waterfront real estate offers a rare combination of luxury living, long-term appreciation, and rental income potential. With limited shoreline availability and increasing urban development, waterfront homes are becoming more exclusive every year.

Key reasons buyers prefer waterfront properties:

- Premium lifestyle and uninterrupted views

- Higher resale value compared to inland properties

- Strong demand for short-term and long-term rentals

- Resilience during market fluctuations

Top Waterfront Property Locations to Watch in 2026

When investing in waterfront homes, location defines value.

High-Growth Waterfront Destinations:

- Dubai Marina & Dubai Creek Harbour – Luxury, infrastructure, and strong ROI

- Palm Jumeirah – Ultra-premium beachfront villas and apartments

- Mumbai Sea-Facing Residences – Limited supply, high capital appreciation

- Goa Waterfront Villas – Tourism-driven rental demand

- International Picks – Miami, Lisbon, and Bali coastal developments

Buyer’s Checklist: What to Look for Before Buying Waterfront Properties

1️⃣ Legal Clearances & Coastal Regulations

Ensure the property complies with coastal zone regulations, environmental norms, and local building approvals. Waterfront properties often fall under special zoning laws.

Tip: Always verify title deeds and shoreline ownership rights.

2️⃣ Flood Risk & Climate Resilience

In 2026, climate safety is a top priority. Look for:

- Elevated construction

- Advanced drainage systems

- Flood-resistant materials

- Insurance coverage for coastal risks

3️⃣ Quality of Construction

Saltwater exposure can affect structures over time. Choose developers known for:

- Marine-grade materials

- Anti-corrosion finishes

- Long-term maintenance plans

4️⃣ Rental Yield & Investment Potential

Waterfront homes often generate 20–30% higher rental income than standard properties.

Check:

- Short-term rental permissions

- Tourist footfall

- Average occupancy rates

- Projected rental yield for 2026

5️⃣ Amenities & Community Living

Top waterfront developments now offer:

- Private beach access

- Marina berths

- Waterfront promenades

- Smart home features

- Wellness and leisure facilities

These amenities significantly boost resale value.

6️⃣ Connectivity & Infrastructure

Luxury alone isn’t enough. Ensure easy access to:

- Airports

- Business hubs

- Schools & hospitals

- Retail and dining zones

Well-connected waterfront properties outperform isolated locations.

7️⃣ Long-Term Appreciation Outlook

Evaluate future infrastructure projects, tourism growth, and government investment in the area. Waterfront zones linked to smart city or tourism initiatives tend to appreciate faster.

Waterfront Property Investment Tips for 2026

- Buy early in under-development waterfront zones

- Focus on branded or master-planned communities

- Prefer properties with flexible payment plans

- Work with trusted real estate consultants

Final Thoughts

Buying a waterfront property in 2026 is both a lifestyle upgrade and a smart investment move. With the right checklist—covering legality, construction quality, rental yield, and future growth—you can secure a premium asset that delivers long-term value.

Whether you’re looking for a luxury waterfront home or a high-return waterfront property investment, informed decisions make all the difference.